English

English-

English

English -

Español

Español -

Português

Português -

русский

русский -

Français

Français -

日本語

日本語 -

Deutsch

Deutsch -

tiếng Việt

tiếng Việt -

Italiano

Italiano -

Nederlands

Nederlands -

ภาษาไทย

ภาษาไทย -

Polski

Polski -

한국어

한국어 -

Svenska

Svenska -

magyar

magyar -

Malay

Malay -

বাংলা ভাষার

বাংলা ভাষার -

Dansk

Dansk -

Suomi

Suomi -

हिन्दी

हिन्दी -

Pilipino

Pilipino -

Türkçe

Türkçe -

Gaeilge

Gaeilge -

العربية

العربية -

Indonesia

Indonesia -

Norsk

Norsk -

تمل

تمل -

český

český -

ελληνικά

ελληνικά -

український

український -

Javanese

Javanese -

فارسی

فارسی -

தமிழ்

தமிழ் -

తెలుగు

తెలుగు -

नेपाली

नेपाली -

Burmese

Burmese -

български

български -

ລາວ

ລາວ -

Latine

Latine -

Қазақша

Қазақша -

Euskal

Euskal -

Azərbaycan

Azərbaycan -

Slovenský jazyk

Slovenský jazyk -

Македонски

Македонски -

Lietuvos

Lietuvos -

Eesti Keel

Eesti Keel -

Română

Română -

Slovenski

Slovenski

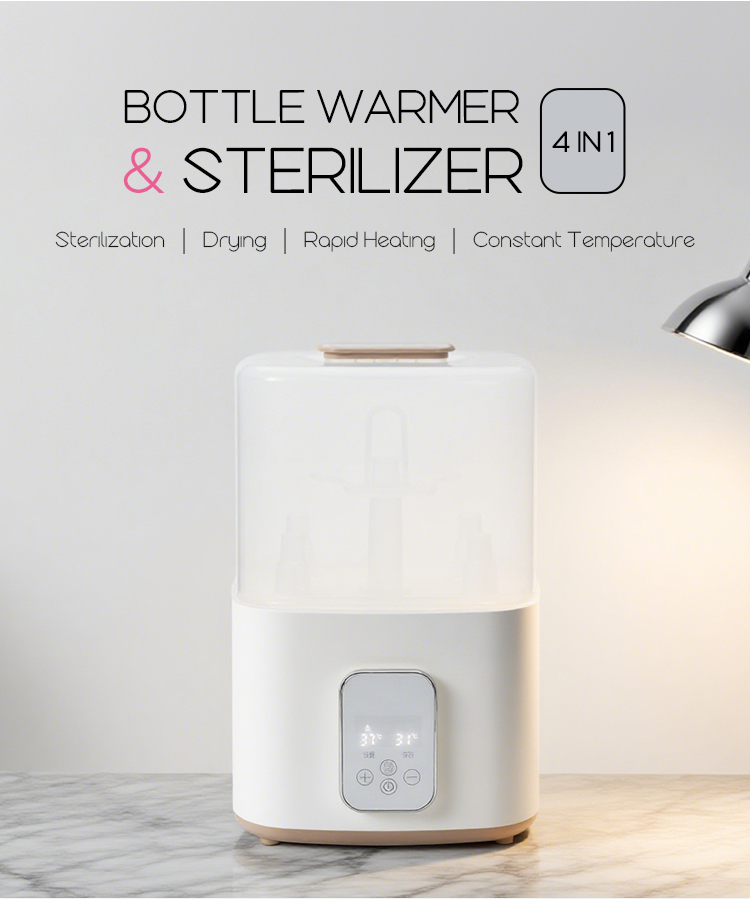

Tunisia's Baby Bottle Warmer Market: Outlook and the Role of Chinese Suppliers Like Joystar

2025-11-15

Tunisia, a key North African maternal and infant market, has seen steady growth in its baby bottle warmer segment, driven by demographic shifts and upgraded parenting concepts. This article examines the market’s H1 2025 performance, 2026 forecast, and the pivotal role of Chinese suppliers—exemplified by Joystar Electrical Appliances Manufacturing Co.,Ltd.—in meeting local demand.

H1 2025 marked positive growth for Tunisia’s baby bottle warmer sales. Fueled by a rising newborn population and growing focus on scientific childcare, the market reached ~4.2 million Tunisian Dinars ($1.4 million), a 5.2% year-on-year increase. Young parents’ reliance on e-commerce and strong demand for mid-range, cost-effective products—balancing affordability and functionality—further boosted this momentum.

The 2026 outlook remains upbeat, with a projected 5.5% annual growth. Key drivers include Tunisia’s expanding maternal and infant market (5% annual growth), rising interest in smart warmers with precise temperature control, and improved cross-border logistics—advantages Chinese suppliers are well-positioned to leverage.

China accounts for over 60% of Tunisia’s baby bottle warmer imports, with Joystar standing out as a reliable partner. Established in 2006, Joystar boasts 19 years of expertise in maternal and baby appliances, serving 100+ countries. Its 15,000㎡ modern factory, 15+ engineer R&D team, and adherence to ISO9001:2015/ISO13485:2016 (plus CGMP, BSCI, FCCA certifications) ensure quality. Products hold CE, UL, RoHS, and REACH certifications, addressing safety concerns critical for Tunisian parents.

Joystar’s competitiveness lies in both production capacity and innovation. It operates 100,000-class dust-free workshops, 40+ production lines (8 for electrical appliances, 18 injection molding machines), and holds 100+ design patents. With 15 years of OEM/ODM experience and partnerships with Pigeon, Nuby, and Beurer, Joystar offers diverse solutions—from basic models to smart versions—at price points aligned with Tunisia’s consumption capacity. China’s robust logistics network, paired with Tunisia’s efficient maritime links, ensures timely delivery.

In conclusion, Tunisia’s baby bottle warmer market will keep expanding in 2026. Chinese suppliers like Joystar, with their quality assurance, production scale, and cost-effectiveness, will remain integral to meeting local demand. As Tunisian parents prioritize safe, convenient childcare, Joystar’s “high quality, strong innovation, excellent service” commitment positions it well to support the market’s growth.